Many applicants struggle with equipment loan applications due to financing pitfalls and application errors. Misinterpretations of loan terms like repayment structures, interest rates, and collateral requirements lead to costly mistakes and approval setbacks. Common misconceptions include assuming the approved loan amount covers all costs and neglecting to review repayment schedules. By understanding these potential obstacles and accurately presenting their financial information, applicants can avoid financing pitfalls, application errors, and loan challenges, ensuring a smoother path to securing funding.

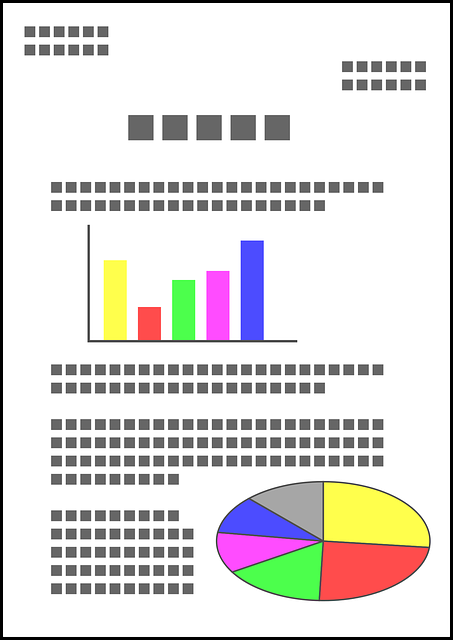

“Avoid these common equipment loan application errors at all costs! Even minor misinterpretations of terms and conditions, inadequate financial documentation, or inaccurate information can lead to approval setbacks and costly mistakes. Understanding these financing pitfalls is crucial to ensuring a smooth loan process. This guide sheds light on the top 4 misconceptions that often arise during applications, helping you navigate the challenges and increase your chances of successful funding for your equipment needs.”

- Misinterpretation of Loan Terms and Conditions

- Inadequate Financial Documentation

- Inaccurate Information on Application Forms

- Ignoring Credit History and Repayment Capacities

Misinterpretation of Loan Terms and Conditions

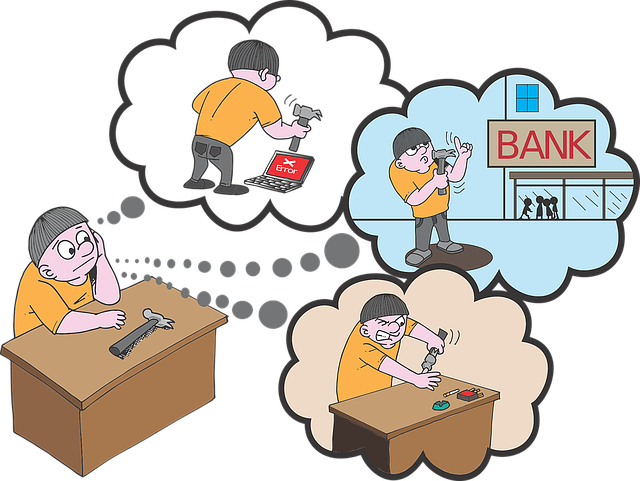

Many applicants often face significant challenges and financing pitfalls when applying for equipment loans due to a lack of understanding of the terms and conditions attached to such loans. These application errors can lead to costly mistakes that hinder their chances of securing funding. The intricacies involved in loan agreements, including repayment structures, interest rates, and collateral requirements, are often misinterpreted, causing confusion and ultimately resulting in approval setbacks.

One common misconception is assuming that the loan amount approved reflects the total cost of the equipment. This can lead to financial strain if applicants don’t account for additional fees, taxes, and insurance. Another frequent error is neglecting to review the repayment schedule, which might include unexpected bulk payments or penalties for early repayment. Such misconceptions not only create loan challenges but also put a strain on cash flow, potentially damaging business operations.

Inadequate Financial Documentation

Inaccurate Information on Application Forms

Inaccurate information on application forms is one of the most common equipment loan application errors, leading to significant financing pitfalls and approval setbacks. Applicants often fall into the trap of assuming that providing slightly exaggerated figures or skipping minor details won’t make a difference. However, these misconceptions can result in costly mistakes, causing delays or even outright rejection. Lenders carefully scrutinize each piece of information to assess risk and ensure responsible lending practices.

These application errors can stem from a variety of causes, including haste, poor record-keeping, or an unwillingness to disclose certain aspects of one’s financial history. To avoid these loan challenges, applicants should take the time to double-check their figures, clarify ambiguous sections, and present a comprehensive, accurate picture of their financial standing. Addressing these financing pitfalls upfront can save valuable time and effort in the long run.

Ignoring Credit History and Repayment Capacities

Many applicants often fall into the trap of ignoring their credit history and repayment capacities when filling out equipment loan applications. This is a significant financing pitfall that can lead to approval setbacks and costly mistakes. Lenders carefully assess an applicant’s financial health and ability to repay to mitigate risk, so omitting or misrepresenting this information is a recipe for loan challenges.

Misconceptions about credit history often stem from the belief that only those with spotless credit records are eligible for loans. However, lenders are more interested in understanding your overall repayment behavior and financial obligations. Demonstrating responsible borrowing and timely payments, regardless of credit score, can enhance your application’s chances. Similarly, assessing repayment capacities involves more than just current income; it requires evaluating factors like assets, liabilities, and employment stability to ensure you can meet the loan’s terms.