Startups and SMEs often face challenges in equipment financing due to application errors, such as inaccurate financial statements and missing documents. To avoid these issues, businesses should thoroughly review requirements, gather all necessary materials, and double-check financial and business plan details before submission. Learning from real-world case studies of common mistakes, like unaccounted maintenance costs or obsolete assets, is crucial to understanding operational needs, potential hidden expenses, and adapting to technological advancements in equipment financing agreements.

Avoiding costly mistakes in equipment financing is essential for businesses looking to optimize their investments. This comprehensive guide delves into the heart of common application errors that can lead to financial setbacks. By understanding these pitfalls, you’ll gain valuable strategies to prevent them. From misinterpreting terms to overlooking hidden fees, we explore real-world examples through case studies, offering practical insights to ensure a smooth financing process. Mastering these techniques will empower you to make informed decisions, avoiding expensive blunders.

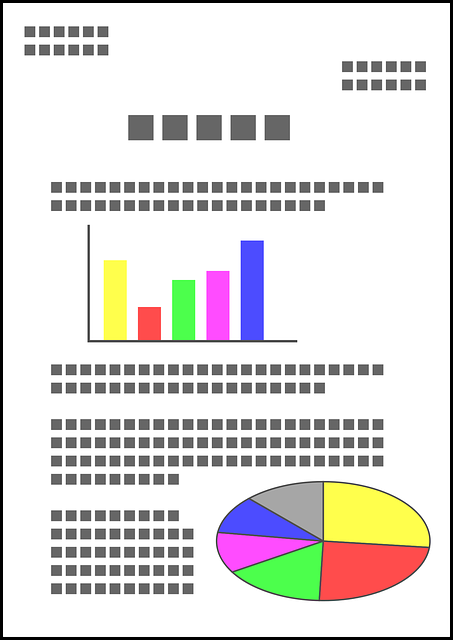

- Understanding Common Application Errors in Equipment Financing

- Strategies to Prevent Costly Mistakes During the Financing Process

- Case Studies: Learning from Real-World Examples of Equipment Financing Blunders

Understanding Common Application Errors in Equipment Financing

Many businesses, especially startups and SMEs, fall into common pitfalls when applying for equipment financing due to a lack of understanding or preparation. These application errors can lead to delayed funding or even rejection, causing significant setbacks in their operations. One of the primary mistakes is failing to provide accurate financial statements, which are crucial for lenders to assess creditworthiness. Inaccurate or outdated information may cause lenders to perceive your business as high-risk.

Additionally, incomplete applications are another frequent issue. Lenders require detailed documentation, including business plans, equipment specifications, and expected ROI. Submitting a missing document or omitting vital sections can delay the review process. It’s essential to thoroughly review all application requirements and gather all necessary materials before submitting your request to avoid these application errors.

Strategies to Prevent Costly Mistakes During the Financing Process

Preventing costly mistakes during the equipment financing process is key to ensuring a smooth and beneficial experience for businesses. One of the most common pitfalls is application errors, often stemming from incomplete or inaccurate information. To avoid this, thoroughness is crucial; double-check all details, from financial statements to business plans, before submitting your application. Clear communication with lenders and careful attention to application requirements can significantly reduce the risk of delays or rejections due to errors.

Additionally, understanding the terms and conditions of the financing agreement is vital. Don’t be shy to ask questions; seek clarification on interest rates, repayment schedules, and any hidden fees. Taking the time to thoroughly read and comprehend the contract will help you avoid unexpected financial burdens later on.

Case Studies: Learning from Real-World Examples of Equipment Financing Blunders

In the realm of equipment financing, learning from real-world examples can be a valuable asset in avoiding costly mistakes. Case studies often reveal overlooked application errors that lead to significant financial burdens and operational challenges for businesses. For instance, a tech startup recently secured funding for state-of-the-art manufacturing machinery but failed to account for unexpected maintenance costs, resulting in a strain on their cash flow within the first year. This blunder highlights the importance of thoroughly understanding operational requirements and potential hidden expenses before finalizing financing terms.

Another notable example involves a healthcare provider who invested heavily in advanced medical equipment without considering the long-term depreciation value. As technology rapidly evolves, their assets quickly became obsolete, leaving them with substantial losses when attempting to refinance or sell. This scenario emphasizes the need for flexible financing plans that adapt to changing market dynamics and technological advancements, ensuring businesses can navigate evolving landscapes without unexpected financial setbacks.