Seeking equipment loans can be fraught with financial challenges and misconceptions, leading to costly mistakes like application errors, misinterpreted terms, and unfavorable loan conditions. To avoid these financing pitfalls, prospective borrowers must carefully review agreements, understand the approval process beyond credit scores, and dispel myths around loan challenges. Strategic navigation includes thorough applications, clear communication, strong financial standing, and exploring alternative lenders to prevent application errors and approval setbacks.

“In the world of heavy equipment acquisition, navigating financing can be a complex labyrinth. This article illuminates the often-overlooked ‘traps’ and ‘pitfalls’ in equipment loan applications, addressing crucial aspects that often lead to financial hurdles. We dissect common misconceptions surrounding financing pitfalls, revealing how application errors can significantly impact loan approvals. Furthermore, we highlight costly mistakes to avoid during borrowing processes. By understanding these challenges, from missteps in applications to navigating approval setbacks, readers gain essential strategies to overcome loan challenges and secure funding smoothly.”

- Understanding Financing Pitfalls and Common Misconceptions

- The Impact of Application Errors on Equipment Loans

- Costly Mistakes to Avoid When Borrowing for Equipment

- Navigating Approval Setbacks: Tips for Success

- Strategies to Overcome Loan Challenges and Secure Funding

Understanding Financing Pitfalls and Common Misconceptions

Many individuals looking to borrow equipment through loans often find themselves navigating a maze of financing pitfalls and common misconceptions. One of the primary challenges is understanding the intricate details of loan agreements, which can be complex and nuanced. Misinterpreting terms like interest rates, repayment periods, and hidden fees can lead to costly mistakes. For instance, an applicant might assume that a lower monthly payment means less financial strain only to discover later that they’ve agreed to longer term, resulting in paying more in interest over time.

Another set of misconceptions surrounds the approval process. Some borrowers believe that their credit score is the sole determinant of loan approval, ignoring other factors like equipment appraisals and business financial health. This can lead to application errors and approval setbacks when lenders find discrepancies between expected and actual business performance. It’s crucial for prospective borrowers to dispel these myths, thoroughly review all loan terms, and seek clarification on any ambiguous clauses to avoid these financing pitfalls and ensure a smoother borrowing experience.

The Impact of Application Errors on Equipment Loans

Applying for an equipment loan can be a complex process, and small mistakes or misconceptions in your application can lead to significant challenges. Application errors, such as incorrect financial information, inadequate business documentation, or misrepresented assets, may cause immediate approval setbacks. These errors can result in delayed access to much-needed funding, leading to costly delays for businesses relying on new equipment for operations.

Moreover, financing pitfalls await applicants who are unaware of the implications of their application mistakes. Incorrectly filled out forms, missing documents, or unrealistic financial projections can lead to loan denials or higher interest rates. Understanding these potential issues and ensuring accuracy from the outset is crucial to avoiding costly mistakes.

Costly Mistakes to Avoid When Borrowing for Equipment

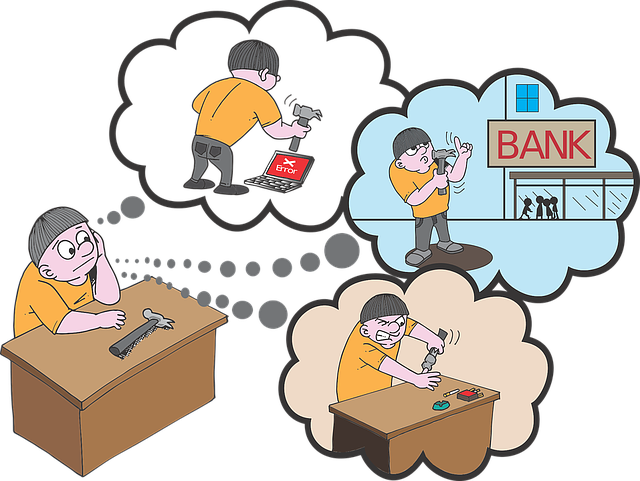

When borrowing for equipment, it’s easy to fall into several financing pitfalls that can lead to significant costs and delays. One of the most common costly mistakes is making application errors, such as incorrect or incomplete information. These errors not only slow down the approval process but also increase the chances of a rejection, forcing you back to square one. Another misconception many business owners have is assuming their creditworthiness will secure them the best loan terms. However, without a clear understanding of your financial standing and the equipment financing market, you might end up with less favorable rates and conditions.

Approval setbacks can also be costly, often resulting from not considering all the associated fees and hidden costs. Many applications are denied due to outstanding debts or unexpected cash flow issues that were not anticipated during the initial planning. Additionally, rushing into a decision without thoroughly evaluating different loan options can lead to long-term financial challenges. Taking time to research various lenders, compare interest rates, and understand the terms and conditions of each loan offer is crucial in avoiding these pitfalls.

Navigating Approval Setbacks: Tips for Success

Navigating Approval Setbacks: Tips for Success

When seeking equipment loans, approval setbacks are a common challenge. These can arise from application errors, misconceptions about financing pitfalls, or even costly mistakes in preparing your documents. It’s crucial to approach these loan challenges with a strategic mindset. First, thoroughly review your application and ensure all information is accurate and complete. Double-check deadlines and requirements to avoid any confusion.

Moreover, clear communication with lenders is key. Seek clarification on any issues or concerns they raise. Understanding the specific reasons behind approval setbacks can help you address them effectively. Additionally, maintaining a strong financial standing and having collateral ready can significantly improve your chances of success. By being proactive and well-prepared, you can navigate these setbacks and increase your likelihood of securing the equipment financing you need without falling into costly mistakes.

Strategies to Overcome Loan Challenges and Secure Funding

When navigating equipment loan options, understanding potential pitfalls and implementing strategic solutions is key to securing funding smoothly. One common challenge is application errors; careful review of loan requirements and meticulous completion of paperwork can prevent these mistakes. Misconceptions about financing terms and conditions often lead to costly errors; educating yourself on interest rates, repayment periods, and collateral expectations empowers informed decision-making.

To overcome loan challenges, build a robust business case demonstrating your ability to repay. Keep detailed financial records and provide transparent data to address approval setbacks. Additionally, exploring alternative lenders or industry-specific financing programs can offer tailored solutions, avoiding generic banking loans that may come with stringent requirements.