Overlooking critical aspects in equipment loan applications can lead to significant costly mistakes, including rejections or less favorable terms due to errors like incomplete forms, missing documents, financial inaccuracies, and lack of clarity. To avoid these issues, lenders must scrutinize red flags, streamline digital applications, ensure thorough verification, maintain open communication, and establish consistent best practices for prompt issue resolution. By doing so, they can mitigate risks, prevent delays, and foster productive collaborations in equipment loan processes.

Navigating equipment loan applications can be a complex process, filled with potential pitfalls and costly mistakes. This article guides you through common issues, from missing crucial details to identifying red flags early on. We delve into streamlining the application process, resolving disputes, and implementing best practices to prevent future problems. Understanding these key areas is essential for a smooth borrowing experience, ensuring you avoid expensive omissions and navigate the journey with confidence.

- Understanding Common Equipment Loan Application Mistakes

- Costly Omissions: What Often Goes Unnoted

- Red Flags: Identifying Potential Issues Early

- Streamlining the Process: Tips for a Smooth Application

- Resolving Disputes: When Things Don't Go as Planned

- Best Practices: Preventing Future Problems

Understanding Common Equipment Loan Application Mistakes

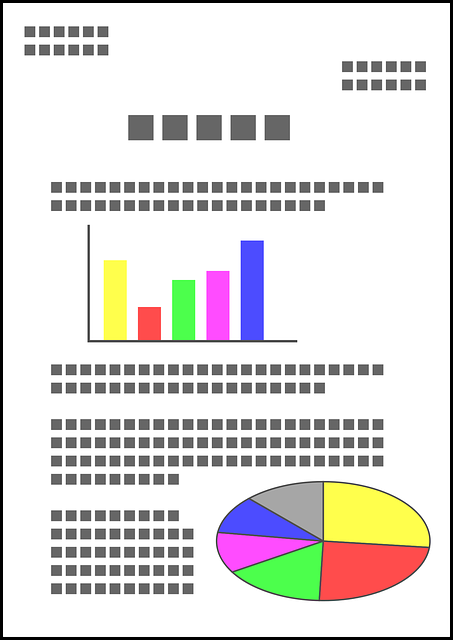

Many applications for equipment loans meet with rejection or face delays due to avoidable costly mistakes. These blunders can range from incomplete application forms to failure to provide necessary supporting documents. Some applicants might not understand the specific requirements of different loan types or overestimate their ability to repay.

For instance, failing to disclose existing debts or inaccurate financial information can raise red flags for lenders. Equally problematic is not demonstrating a clear understanding of the intended use of the equipment or having a solid business plan in place. These costly mistakes often lead to rejections or, worse, loan terms that are less favorable.

Costly Omissions: What Often Goes Unnoted

When applying for equipment loans, many individuals and businesses make costly omissions that can lead to significant issues down the line. A common pitfall is overlooking the need for adequate insurance coverage. Equipment loan agreements often require specific types of insurance, such as liability and property damage coverage, to protect both the lender and borrower. Failure to secure this coverage can result in financial losses if an accident or damage occurs during use.

Additionally, not considering the long-term maintenance costs can be a major mistake. Borrowers sometimes focus solely on acquiring the equipment, forgetting that regular upkeep is essential to prevent breakdowns and costly repairs. Neglecting this aspect may lead to unexpected expenses, especially for specialized machinery with intricate parts. Such omissions can not only strain budgets but also jeopardize the entire loan agreement, potentially causing delays or even default.

Red Flags: Identifying Potential Issues Early

Identifying red flags early can help avoid costly mistakes in equipment loan applications. These warning signs might include discrepancies in the application form, such as incomplete or inaccurate information provided by the borrower. For instance, a borrower might overstate their ability to repay the loan or underplay existing financial obligations. Another red flag could be a lack of proper documentation, such as proof of income or employment, which is essential for assessing repayment capacity.

Moreover, a thorough background check is crucial. This includes verifying the borrower’s credit history and reputation, as well as checking references to ensure they have a track record of responsible borrowing. Failure to conduct these checks could lead to default risks, causing financial losses for the lender and potentially damaging their reputation. Staying vigilant and addressing these red flags promptly can help mitigate such risks.

Streamlining the Process: Tips for a Smooth Application

Streamlining the equipment loan application process is essential to avoid costly mistakes and ensure a smooth experience for all parties involved. Firstly, organizations should implement a clear and user-friendly online application system. This digital approach simplifies the procedure by allowing applicants to fill out forms efficiently, attaching necessary documents as required. An intuitive interface with real-time validation checks can help prevent errors early on, reducing the need for extensive back-and-forth communication.

Additionally, establishing straightforward eligibility criteria and clearly communicating them beforehand saves time. Defining clear cutoffs for factors like credit history, business age, and equipment value helps prequalify applicants, preventing unnecessary delays. Regular updates to this criteria should be communicated effectively to keep everyone informed. This proactive approach ensures a more manageable application flow, minimizing potential hold-ups and promoting a positive loan application experience.

Resolving Disputes: When Things Don't Go as Planned

When equipment loan applications aren’t handled smoothly, it can lead to significant delays and even costly mistakes. Disputes may arise due to misunderstandings about the terms of the loan, unexpected changes in project timelines, or discrepancies in equipment condition upon delivery. To resolve these issues, clear communication is key. Both parties should have a detailed understanding of the agreement, including responsibilities for maintenance, return conditions, and potential penalties for late returns or damage.

Mediation becomes necessary when discussions break down. Having a neutral third party facilitate negotiations can help to quickly reach mutually agreeable solutions. This not only saves time but also prevents escalations that could lead to legal complications or long-term strain in the relationship between the lender and borrower. By addressing disputes promptly and efficiently, it’s possible to maintain a positive experience despite initial challenges, ensuring future collaborations remain smooth and productive.

Best Practices: Preventing Future Problems

To prevent future issues with equipment loan applications, it’s crucial to establish clear and consistent best practices. Start by thoroughly reviewing each application form, double-checking for accuracy and completeness. Inaccurate or missing information can lead to delays, confusion, and ultimately, costly mistakes. Implement a comprehensive onboarding process that educates all stakeholders on the expectations, responsibilities, and procedures related to equipment loans.

Regular communication is key. Maintain open lines of dialogue between loan applicants, equipment owners, and administrators. Schedule periodic check-ins, provide updates on application statuses, and address any concerns promptly. This proactive approach helps identify potential issues early on, preventing them from escalating into major problems. Additionally, creating a centralized system for document management and tracking can ensure transparency and accountability throughout the entire process.