Acquiring new equipment requires strategic financial planning to avoid common financing pitfalls. Businesses face challenges like insufficient capital, poor cost estimation, and cash flow issues, hindering equipment upgrades. Effective cash flow management, thorough due diligence, robust financial planning, and diverse financing options are key to navigating these risks. Non-traditional loan alternatives offer flexible solutions, while strategic approaches, addressing root causes, and diversifying funding sources empower companies to overcome financing pitfalls for sustainable growth.

In today’s competitive landscape, equipment acquisition is a cornerstone of business growth. However, navigating the complex world of equipment financing can pose significant challenges, leading to common financing pitfalls that hinder progress. This article delves into understanding these pitfalls, exploring their impact on cash flow management and uncovering strategic solutions. From risk mitigation techniques to non-traditional financing options, we provide effective resolution techniques to overcome financing challenges and drive business success.

- Understanding Common Financing Pitfalls in Equipment Acquisition

- Impact of Inefficient Cash Flow Management on Equipment Financing

- Strategies to Mitigate Risks and Secure Smooth Financing

- Exploring Alternatives: Non-Traditional Financing Options

- Effective Resolution Techniques for Overcoming Financing Challenges

Understanding Common Financing Pitfalls in Equipment Acquisition

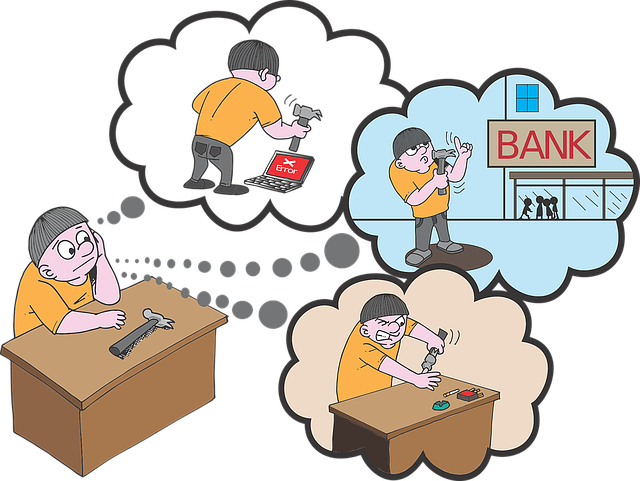

Acquiring new equipment is a significant investment for any business, and understanding the potential financing pitfalls can make or break a successful purchase. One of the most common issues is insufficient capital, which can prevent businesses from securing the necessary funding for high-value assets. This may lead to delays in acquiring modern machinery or technology, potentially giving competitors an edge.

Another financing pitfall involves poor planning and unrealistic expectations. Some companies underestimate the long-term costs associated with equipment, including maintenance, repairs, and obsolescence. As a result, they might struggle to make consistent payments, impacting their cash flow and creditworthiness. Recognizing these challenges is the first step towards implementing effective strategies to navigate and resolve financing issues successfully.

Impact of Inefficient Cash Flow Management on Equipment Financing

Inefficient cash flow management can significantly exacerbate equipment financing challenges for businesses, creating a cascade of issues that compound existing financing pitfalls. When organizations struggle to manage their cash inflows and outflows effectively, they may find themselves in a position where meeting equipment leasing or purchase obligations becomes strained. This can lead to delayed payments, missed deadlines, and even default on financing agreements, all of which have detrimental effects on relationships with lenders and suppliers.

Such inefficient practices often result in insufficient funds to cover the cost of new equipment or unexpected maintenance expenses for existing assets. Consequently, businesses may be forced into costly alternatives, such as extending payment terms or arranging additional loans, further complicating their financial landscape. Effective cash flow management is therefore a strategic imperative, enabling organizations to navigate financing pitfalls and secure a stable foundation for equipment acquisition and maintenance.

Strategies to Mitigate Risks and Secure Smooth Financing

To mitigate risks and ensure smooth equipment financing, businesses should proactively identify potential financing pitfalls early in the process. One effective strategy is to conduct thorough due diligence on both the equipment and the financing provider. This includes evaluating the equipment’s condition, expected lifespan, and resale value, as well as assessing the provider’s reputation, terms, and conditions. A comprehensive analysis helps in making informed decisions and avoiding surprises that could lead to costly delays or defaults.

Additionally, creating a robust financial plan and maintaining strong creditworthiness are vital. Businesses should project their cash flow to ensure they can comfortably meet repayment obligations. Diversifying financing options and negotiating flexible terms with providers can also help buffer against unforeseen circumstances. By taking these proactive steps, organizations can minimize financing pitfalls and secure smoother equipment acquisition and maintenance.

Exploring Alternatives: Non-Traditional Financing Options

When businesses face financing pitfalls, exploring alternatives to traditional loan options can be a game-changer. Non-traditional financing methods offer flexible and innovative solutions for equipment acquisition, catering to various business needs. These options include leasing, vendor financing, and peer-to-peer lending—each presenting unique advantages.

Leasing, for instance, provides businesses with the ability to use equipment without the long-term commitment of ownership. Vendor financing programs allow manufacturers to offer tailored financing plans directly to buyers, streamlining the purchase process. Peer-to-peer lending platforms tap into a community of investors, making smaller equipment acquisitions more accessible. By considering these non-traditional approaches, companies can navigate financing pitfalls and secure the necessary resources for their operational growth.

Effective Resolution Techniques for Overcoming Financing Challenges

When confronted with financing challenges, a strategic and proactive approach is crucial. Effective resolution techniques involve a combination of financial planning, creative thinking, and utilizing available resources. One key strategy is to assess the root cause of the financing pitfall; whether it’s cash flow constraints, lack of collateral, or poor creditworthiness. Addressing these underlying issues through measures like cost cutting, securing additional guarantees, or restructuring debt can significantly enhance a company’s financial position.

Moreover, exploring alternative financing options and diversifying funding sources is vital. This could include seeking government grants, partnering with investors, or leveraging asset-based financing. Building strong relationships with lenders and financial institutions also plays a strategic role in accessing better terms and conditions. By adopting these resolution strategies, businesses can overcome financing challenges, ensuring sustainable growth and success.